Despite significant concerns about revenue and labor shortages, 75% of surveyed Chester County businesses say they plan to return to pre-COVID operations and 77% report no change in the size of their physical workspace and facilities.

Despite significant concerns about revenue and labor shortages, 75% of surveyed Chester County businesses say they plan to return to pre-COVID operations and 77% report no change in the size of their physical workspace and facilities.

That’s according to a survey conducted by the Chester County Economic Development Council (CCEDC) in partnership with Restore Chester County. Twenty-four survey questions centered around “return to work” practices including telework, vaccination policies, travel policies, facility usage and space planning.

“We have been collecting data on business needs and challenges since the beginning of the pandemic. This latest survey – with an eye toward fully reopening the economy – is especially important. It is critical that we understand the business practices, policies and behaviors that are going on right now, so we can support the ripple effects to our economy,” says CCEDC Chief Operating Officer Michael Grigalonis.

CCEDC administered the survey in partnership with Restore Chester County, a group of business, economic, education and government leaders from across Chester County, brought together by the Chester County Commissioners to focus on the reopening and restoration of Chester County’s quality of place brought on by the pandemic.

Chester County Commissioners Marian Moskowitz, Josh Maxwell and Michelle Kichline noted, “From the very beginning of the pandemic, Chester County’s business and economic focus was to ‘steady the course’ to survive the darkest days of COVID, then move forward and grow. This included the provision of PPE, allocating tens of millions of dollars in grants, guidance on how to apply for those grants, and support for re-opening and beyond.

“Our strength in planning and our business partnerships are great advantages in moving forward economically, and feedback from businesses through a survey such as this, helps us as we work to reshape our robust economy.”

The confidential survey was distributed primarily via the networks of CCEDC, Chester County Government and the Restore Chester County Task Force. 436 responses were received from July 28th to the survey’s closing on August 31st.

KEY FINDINGS

Revenue/Sales Trends

- 32% of businesses reported that their revenue is either at or above pre-COVID levels.

- The majority of respondents from Banking/Finance (70%), Construction, and Manufacturing reported revenue levels back to pre-COVID levels or higher.

- 68% of business reported revenues have not recovered to pre-COVID levels.

- Forward looking, 40% of respondents don’t believe they’ll recover to pre-COVID levels. 60% believe they will.

- Banking/Finance, Construction and Manufacturing are the most optimistic looking forward. Personal Services, Hospitality and Education are all the least optimistic. (The majority believe their revenues won’t return to pre-COVID levels)

Operational and Safety Responses

- 40% of respondents will require face masks for employees and/or customers.

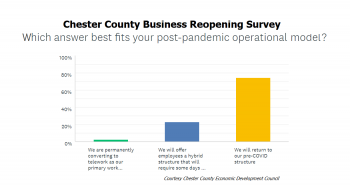

- 34% will offer telework, either full-time or through a hybrid model.

- 75% of respondents will return to their pre-COVID operations structure.

- Banking/Finance report the largest changes in operational models, shifting to hybrid or full telework.

Vaccine-Related Behaviors and Practices

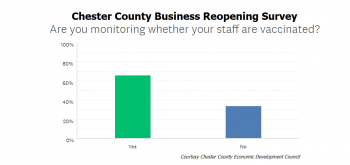

- 66% of employers are tracking the vaccine status of their employees.

- 22% of employers are incentivizing employees to be vaccinated.

- Businesses in Health Care and IT reported the highest percentage of vaccine tracking.

- Labor shortages and supply chain disruption were the biggest challenges facing employers as they reopen.

- Lack of capacity/inability to meet demand and safety fears of customers were also major challenges.

- Arts/Entertainment and Hospitality industries are most concerned about demand returning for their product or service. The primary reason is they believe customers have safety concerns.

- Construction and Distribution/Warehouse related businesses reported high concerns about their ability to meet demand. This is primarily due to challenges with supply chain.

Workforce and Labor

- 91% of businesses reported they are looking to fill “up to 10” openings.

- 8 businesses reported having to fill 50 or more openings.

- Employers reported several issues inhibiting their ability to source talent:

o Extended and rich unemployment benefits were cited as biggest factor.

o Smaller labor pools (Construction and IT businesses in particular) and lack of job skills were other significant factors.

- Only 10% reported “dependent care” as an issue.

- Employers identified networking, social media and “word of mouth” as the most effective recruitment tools.

- Job fairs and recruiters were listed as the least effective.

- Traditional “white collar” employers see the most benefit from flexible work schedules.

- Businesses in Banking/Finance, Education and IT felt strongest that increased compensation is a positive retention tool.

Travel and Meeting Policies

- 85% of businesses have already returned to “face to face” meetings. (93% will return by January 1, 2022.)

- 64% of businesses have returned to their pre-COVID travel policies. Less than 10% report eliminating or dramatically reducing their travel.

Physical Workspace or Facility

- 77% of businesses report no change in the size of their physical operation. 13% plan an increase. 9% project reducing their space.

- 37% of Health Care respondents said they plan to increase the size of their space.

- About 20% of businesses in Banking/Finance, IT and Arts/Entertainment said they plan to decrease the size of their workspace.

Demographics of Survey Respondents:

- 19% Hospitality, 14% Professional Services and 11% Personal Services. <10% for all other industries.

- 35% of respondents were woman-owned businesses. 9% of respondents were minority-owned businesses.

- 83% of respondents were white. Chester County’s population is 85% white.

- 71% of respondents reported gross annual revenue of less than $2 million. 12% of respondents reported revenues of greater than $10 million.

- 76% of respondents reported 20 full-time employees or fewer.

- Responses were submitted from 71 of Chester County’s 73 municipalities. The largest number of respondents came from West Chester, Uwchlan, Phoenixville and West Whiteland.